Why Financial Planning Is Essential for Microgreens Success (And How to Avoid the Profitability Trap)

Financial Planning Overview

It’s no secret that microgreens have developed a reputation for being a high-margin crop. A quick Google search or YouTube dive will tell you trays are selling for $25, $30, even $50. And while the numbers can look exciting, the truth is — most of these stories are missing half the equation.

The part about costs.

The part about labour.

The part about whether those trays were actually sold — or just imagined.

If you’re serious about starting or scaling a microgreens business, then financial planning isn’t optional — it’s foundational. It’s what separates a hobby that costs money from a business that makes money. It’s how you avoid burnout, plan for sustainability, and eventually, build something that pays you back for your time.

In this article, we’ll look at why financial planning matters, what most growers overlook, and how a good crop planner — like the one from Urban Micro — helps you stay grounded in reality from day one.

The Part Most Growers Miss: What Microgreens Actually Cost

Here’s what a lot of online microgreens guides will tell you: “Start with $500 and these five things: trays, seeds, soil, lights, shelf.”

What they often leave out? The other 50 things you’ll also need.

Things like:

- Gloves, knives, bins, and labels

- Watering gear

- Packaging materials

- Coolers and ice packs

- Software for invoices

- Market tents and tables

- Insurance

These aren’t “nice to have” items — they’re essential. And together, they form the foundation of what your real costs will be.

I dump these costs into three basic buckets:

- Variable Costs — things that scale with production like seed, soil, packaging, and labour.

- Infrastructure Costs — shelving, lights, trays, market gear, harvest tools, etc.

- Business Costs — insurance, licenses, websites, transaction fees, and tech tools.

Each of these cost types plays a role in your overall profitability — and if you don’t plan for them, you’ll be blindsided. Financial planning is key for properly identifying all your real expenses.

“There are a lot of what I would call hidden costs or minor costs that just chip away at your profit. It’s really important to understand this and be prepared to spend more than you anticipate.”

Revenue Reality: Why Tray Price is Only Half the Story

Let’s say someone tells you they’re selling trays for $30 each.

Your first reaction: “Wow! That’s amazing.”

Second reaction (hopefully): “Cool. But… how much did it cost to grow that tray? And did you actually sell it, or is this a spreadsheet projections fantasy?”

One of the most common traps new growers fall into is projecting revenue based on ideal outcomes. Like assuming every tray will have a perfect yield, every market customer will pay full price with a smile, and every delivery goes smoothly with zero waste, spoilage, or haggling.

It’s a beautiful dream.

The reality? Trays don’t always yield. Customers don’t always buy. And even if they do, you might be standing in the rain at a farmers market while trying to convince someone your spicy radish mix is worth more than their coffee.

Here’s a simple formula we use in the Urban Micro Crop Planner:

Revenue = Number of Trays Sold × Average Value Per Tray

The key word here is “average.”

That $30 tray? That’s only true if:

- It yielded well,

- You sold every gram at full price,

- You didn’t eat the leftovers or compost them,

- You didn’t offer a discount just to move product at the end of the market.

When you sell across different markets — farmers markets, restaurants, wholesalers — your actual tray price averages out. One tray might bring in $26 at a market, but only $17 from a wholesaler. So don’t get too attached to the high number — it rarely tells the whole story.

“Your revenue is your money coming in. Your profit is what’s left after everyone — including you — gets paid and all your expenses have been covered. Very different things.”

Owner Labour: The Most Frequently Forgotten Expense in Financial Planning

Here’s a wild idea: pay yourself.

Sounds obvious, right? And yet, it’s one of the most commonly skipped steps in financial planning.

In early-stage microgreens businesses, it’s typical for the owner/operator to work full time (or more) without including their own labour as a cost. That works for a while… until you realize you’ve built a business that only “works” when you work for free.

Spoiler: that’s not a business — it’s a very demanding hobby.

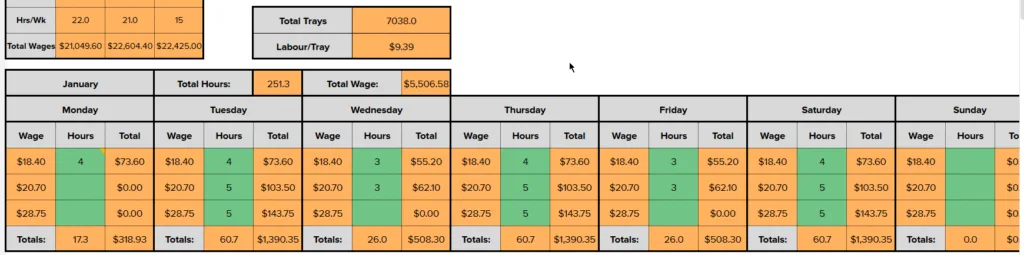

That’s why the Urban Micro Crop Planner includes a built-in labour model. You assign a value to your time (we usually use $18–25/hour), and the planner shows whether your business can afford to pay you. Not just “hope so” — actually afford to.

Think of it like hiring yourself: if you wouldn’t do the job for the pay your business can afford, it’s time to rethink the plan.

“We’re not just planning for profit — we’re planning for sustainability. That means you get paid, too.”

Scale or Fail: Why $100,000/Year Is the Real Break-Even Point

Here’s a number that surprises a lot of new growers:

$100,000 in annual sales is where most microgreens businesses begin to break even.

Wait — what? Isn’t microgreens a small-scale business? Well, reality check: $100,000 is a very small business! Remember – that’s your revenue, not your profit!

Even a “small-scale” business has very real costs. Website. Insurance. Rent. Licensing. Supplies. Packaging. Wages (hopefully). These fixed and semi-fixed costs don’t shrink just because you’re only selling $300 a week. They stick around. They lurk. And they eat your profits like a rodent eating your seeds in a poorly designed seed storage room.

The truth is, at low sales volumes — say, $100 or $200 a week — those business costs chew through your revenue like hungry caterpillars. And if you’re thinking, “Well, I just won’t spend money on those things,” congratulations, you’ve just signed up for a stressful, unpaid job with legal liability.

But scale helps.

At $2,000 a week in sales — which isn’t difficult at all once you’re in a groove — the math starts to work. You can pay yourself. You can reinvest in better equipment. You can afford a little marketing without skipping rent. And much more.

“It’s not just about growing more — it’s about getting enough margin between your revenue and your expenses to make the work worth doing.”

The beautiful thing? Once your systems are in place, increasing sales doesn’t increase costs linearly. Selling 60 trays instead of 50 might add a bit more seed, soil, and packaging — but your rent, your harvest table, your delivery route? They stay the same. That’s where the magic of scale kicks in.

The Tool That Ties Financial Planning All Together

So how do you make sense of all this? (we gave you a few hints on the way…)

Enter the Urban Micro Crop and Financial Planner. It’s not just a spreadsheet — it’s a full business modeling tool designed specifically for microgreens.

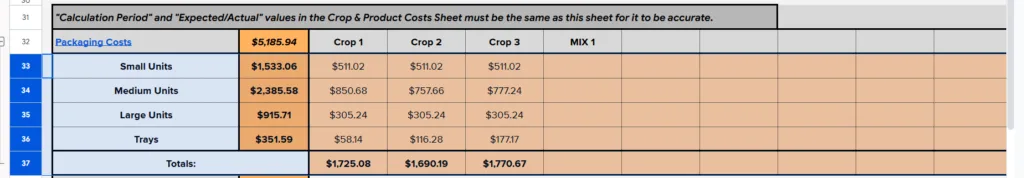

It takes your crop plan — your real production, real yields, and real markets — and translates that into:

- Revenue projections (based on actual tray yields and market prices)

- Variable costs per crop

- Infrastructure and business costs

- Labour modeling (including your wages)

- A final profit/loss picture that helps you decide: Is this viable?

This is what most online microgreens hype skips entirely — and it’s why so many new growers get blindsided when the numbers don’t add up.

“You don’t need to be a seasoned economist. You just need a plan — and a tool that helps you see the full picture before you go all in.”

Final Thought: Financial Planning First, Grow Second

Financial planning isn’t the sexy part of microgreens. It doesn’t get likes on Instagram. It doesn’t come with LED lights or lush harvest trays. But it is the part that keeps your business alive — and helps it grow.

So go ahead and build your shelves (not out of wood, please!) and buy your first bags of seed, but also take a few hours to model your numbers: Understand your costs. Set realistic revenue goals. Pay yourself in the plan — even if you can’t yet in practice.

Because when the numbers work, everything else gets easier.

Leave a Reply